"If the American people ever allow…

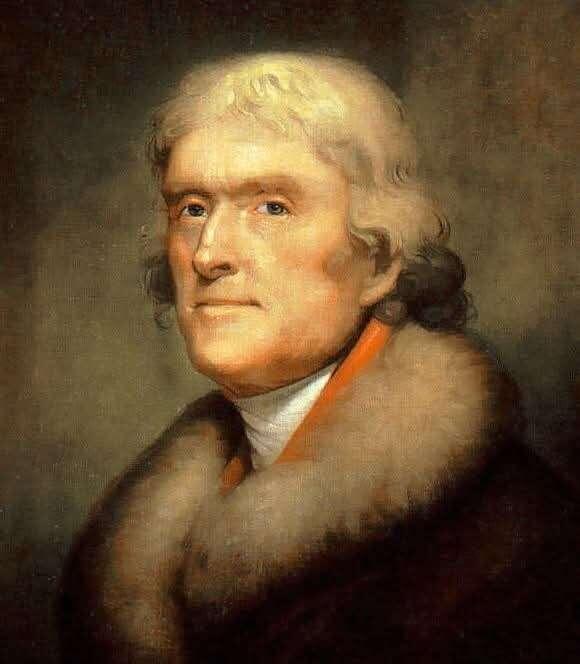

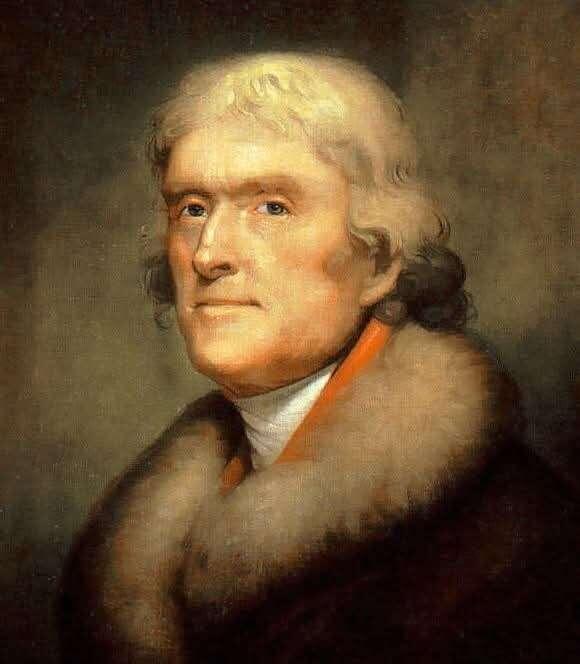

"If the American people ever allow private banks to control the issue of their money, first by inflation and then by deflation, the banks and corporations that will grow up around them (around the banks), will deprive the people of their property until their children will wake up homeless on the continent their fathers conquered.” — Thomas Jefferson, 1802 letter to Secretary of State Albert Gallatin.

We didn't listen. 🤷🏻♂️

Central bank monetary expansion (i.e. quantitative easing, low rates) devalues fiat currencies over time. This inflation risk is a core threat to insurers, eroding the real value of policy reserves, payouts, and premiums. It forces individuals into debt cycles just to maintain basic security, undermining the fundamental purpose of insurance: long-term protection. Inflation, as well as supply and demand of material, is why we're paying higher insurance premiums.

Bitcoin's verifiably scarce, fixed supply offers a potential non-sovereign store of value resistant to inflationary debasement. For agents, this represents a novel, albeit volatile, asset class clients might use to hedge against the systemic inflation that erodes traditional savings and insurance value.

Insurers rely heavily on the stability of the traditional financial system (banks, bond markets, central banks) to manage reserves and meet liabilities. Bail-ins, bank failures, sovereign debt crises, or currency controls represent severe counterparty and systemic risks. However, consecutive perfect storms as Louisiana experienced placed enormous burdens on policyholders.

Bitcoin operates on a decentralized, global network outside direct central bank control. While volatile, its value isn't tied to the solvency of any single bank or government. For agents advising on holistic financial health, Bitcoin represents a form of portfolio diversification and systemic risk hedge – a small allocation could theoretically help preserve wealth outside the traditional system during extreme stress, potentially preventing clients from falling into debt slavery due to systemic collapse.

Excessive personal debt makes us vulnerable (less "insurable") and dependent on the forbearance of creditors and the stability of the system insurers operate within. This dependence limits true financial sovereignty.

Bitcoin enables permissionless savings and global value transfer. Clients holding Bitcoin possess an asset that cannot be easily frozen or confiscated by traditional banks or governments. This fosters greater individual economic sovereignty. Financially sovereign clients are potentially less vulnerable to catastrophic debt spirals and better positioned to maintain adequate insurance coverage.

Central banks' monopoly on money creation and monetary policy is a foundational, but often opaque, systemic risk. Their actions directly impact inflation, interest rates (affecting insurer investments), and overall economic stability.

Bitcoin provides a viable, decentralized alternative monetary network. It fundamentally challenges central banks' control over money by offering:

* Algorithmic, Transparent Policy: No discretionary rate-setting or QE.

* Global Settlement: Bypassing central bank-controlled systems.

* Competition for Reserve Status: As a potential non-sovereign reserve asset.

This introduces significant uncertainty. While potentially reducing long-term inflation risk, Bitcoin's volatility and regulatory ambiguity create new risks to model. It forces insurers to consider scenarios where central bank power is diminished, fiat stability is questioned, and a new, parallel financial system emerges.

It's not going to happen overnight and will be a long process to implement.

Considerations:

* Volatility ≠ Stability:

Bitcoin's extreme price swings currently make it unsuitable as a primary reserve asset for insurers or a stable store of value for near-term liabilities/payouts. It's a high-risk, high-potential-reward?speculative hedge, not a stable currency replacement.

* Regulatory Uncertainty:

Governments will aggressively regulate Bitcoin to protect monetary sovereignty and financial stability. This creates legal and compliance risks.

* Technological Hurdles:

Scalability, energy consumption, custody security, and user experience remain challenges for mass adoption within insurance or everyday finance.

* Not a Debt Eraser:

Bitcoin doesn't eliminate existing fiat-denominated debt. Its value lies in offering an alternative system for saving and transacting outside the debt-based fiat paradigm moving forward.

* Coexistence, Not Immediate Replacement:

Central Banks will adapt rather than disappear. The likely scenario is a complex coexistence of systems. JP Morgan and Bank of America, as an example, are deeply engaged in adapting to the cryptocurrency ecosystem through strategic services and infrastructure. #CBDC

From a risk management perspective, Bitcoin introduces both new hedging opportunities and significant new volatilities and regulatory complexities. While not a panacea and fraught with challenges, Bitcoin demands serious consideration as a disruptive force challenging the monetary status quo. Understanding its implications – both as a potential asset class for client diversification and as a systemic variable reshaping the financial risk landscape – is becoming increasingly essential. It embodies a technological attempt to realize Jefferson's ideal of sound money and individual sovereignty, albeit in a highly volatile and evolving form.

Interesting times to live amongst the BTC Pioneers. 🫡